Here's how to spot a fake GST bill

Updated: Sep 19, 2017, 01.58 PM IST

VIEW IN APP

All eligible businesses must migrate to GST immediately and use GSTIN on their invoices.

All eligible businesses must migrate to GST immediately and use GSTIN on their invoices.

The transition to the goods and services tax ( GST) regime for many shoppers has not been smooth, especially with regards to the bill of a transaction. This is because there have been instances where customers have been given unauthentic or improper bills.

Read on to find out how you can identify an authentic bill and a business that is eligible and compliant with GST rules.

Outlet not eligible yet charging GST

Not all shop owners are required to get themselves registered under GST and get aGSTIN (GST Identification Number). But every bill carrying the GSTIN has to show the break-up of central GST ( CGST) and state GST ( SGST).

Small businesses having an all-India aggregate yearly turnover below Rs 20 lakh (Rs 10 lakh if business is situated in Assam, Arunachal Pradesh, Jammu and Kashmir, Himachal Pradesh, Uttarakhand, Manipur, Mizoram, Sikkim, Meghalaya, Nagaland, or Tripura) need not register.

They may, however, voluntarily opt to register even if the turnover is below the threshold limit. It may so happen that some shop owners who are not eligible and not registered still collect GST from the customer and do not even pass it over to the government.

Collecting GST in old format

It has also been observed that some businesses and shop owners are using old receipts carrying value added tax (VAT)/ taxpayer identification number (TIN) and central sales tax (CST) numbers instead of GSTIN but are still charging central GST (CGST) and State GST (SGST) from customers. GSTIN has to show the break-up of CGST and SGST. "This is an incorrect practice. Effective 1 July, GST is applicable and accordingly compliance is a must. All eligible businesses must migrate to GST immediately and use GSTIN on their invoices. Taxpayers must register with GST where applicable and then charge SGST and CGST," says Archit Gupta, founder and chief executive officer, ClearTax.

Is provisional GST number sufficient?

There are shop owners who are charging CGST and SGST on their bills without the mention of a GSTIN saying that they have applied for GSTIN and will pay the government once it is received or verified. But this is not the correct practice as the mention of GST number in the bill is a must.

But, can the shop owner hide behind the excuse that his final GST number is not verified yet? No, says Gupta. "Businesses which have not yet received their final GSTIN must use their provisional GSTIN to issue invoices, file returns, and adhere to other compliances. Provisional GSTIN is the final GSTIN number itself, so there won't be any retroactive changes to this number," says, Gupta.

As a customer, how do you know if the merchant is tricking you or not? If you notice anything suspicious at a shop, keep the bill handy and follow these steps to check if the GSTN mentioned in the receipt is correct:

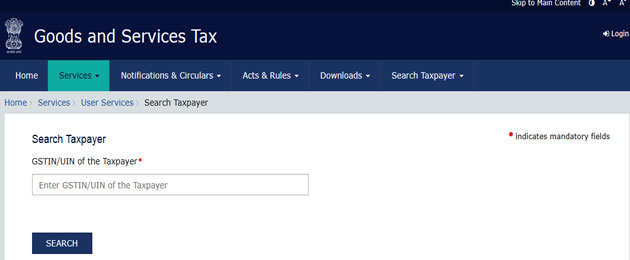

Step 1: Log on to https://www.gst.gov.in

Step 2: Under the 'search taxpayer' dropdown, click on 'search by GSTIN/UIN'

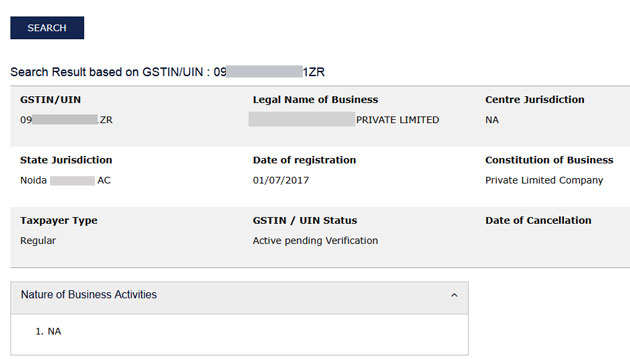

If GSTIN is incorrect, the following message will be displayed:

"The GSTIN/UIN that you have entered is invalid. Please enter a valid GSTIN/UIN."

If GSTIN is correct, the following information along with the GSTIN status will be displayed:

" Legal name of business

" State

" Date of registration

" Constitution of business - private or public limited company, sole-proprietor or partnership

Active pending verification

Even if the portal shows the message 'Active pending verification', the GSTIN is fine. It's the provisional ID issued to the business/shop owner but shows that the GSTIN has been applied for.

Structure of GSTIN

If you are concerned about the GSTIN format itself, here's help. The structure of the 15-digit GSTIN on the bill is standard across the country.

Source: Cleartax.in

* The first two digits represent the state code and every state has a unique code. For instance, state code of Maharashtra 27 ; for Delhi it is 07 ( See bottom for entire list)

* The next 10 digits will be the PAN numbers of the shop owner or the business.

*The 13th digit will be assigned based on the number of registration within a state

* The 14th digit will be Z by default

* The last digit will be for check code. It may be an alphabet or a number to be used for internal purpose by the tax department.

Conclusion

The bill should clearly mention GSTIN showing the breakup for CGST and SGST. And, in case you need to ensure whether GST has been correctly charged, one may clickhere . ( https://cbec-gst.gov.in/gst-goods-services-rates.html. )

If you feel that the seller is not issuing the bill in the proper format or if there is any other concern, one may raise a complaint by writing to: helpdesk@gst.gov.in.

State codes representing the first two digits in GSTIN

Andaman and Nicobar Islands 35

Andhra Pradesh 28

Andhra Pradesh (New) 37

Arunachal Pradesh 12

Assam 18 Bihar 10

Chandigarh 04

Chattisgarh 22

Dadra and Nagar Haveli 26

Daman and Diu 25

Delhi 07

Goa 30

Gujarat 24

Haryana 06

Himachal Pradesh 02

Jammu and Kashmir 01

Jharkhand 20

Karnataka 29

Kerala 32

Lakshadweep Islands 31

Madhya Pradesh 23

Maharashtra 27

Manipur 14

Meghalaya 17

Mizoram 15

Nagaland 13

Odisha 21

Pondicherry 34

Punjab 03

Rajasthan 08

Sikkim 11

Tamil Nadu 33

Telangana 36

Tripura 16

Uttar Pradesh 09

Uttarakhand 05

West Bengal 19

Comments